There are multiple ways grain storage facilities can be justified as a capital investment, such as improving harvest efficiency, reducing drying costs, capturing carry, basis improvement, and expanded marketing opportunities. While the externalities are many, it takes several years of excellent enterprise records to document the actual value of the externalities. This article focuses only on direct benefits to the marketing program. This discussion is most relevant for farmers who can use the futures market effectively for hedging, and less so for farmers who prefer not to use futures markets or work with crops that do not have futures markets.

Some of the most obvious benefits of selling grain out of storage is to avoid selling at traditional seasonal lows at harvest, knowing exactly how much grain is available for sale, ability to respond to rallies as they develop, opportunity to see and lock in carry without any special skills, etc. A major negative to delaying pricing until grain is in the bin is foregoing the opportunity to use forward pricing to capture higher prices early in the production cycle.

This analysis is for 2012-2021, the latest 10 year of completed records. Basis patterns are very location specific, and the data in the study is from Iowa. When forward pricing is not used, it is simple enough to compare the post-harvest sales to the traditionally low prices at harvest and assign the gain to the storage facility. If pre-harvest hedging is used, the analysis is a bit more complicated. Capturing the basis improvement requires ownership and storage, but capturing price increases can be achieved with futures or options without storage. The potential generation of additional revenue to cover the cost of storage facilities, supporting equipment, and additional labor depends on how much of the gain from harvest to post-harvest delivery is generated by basis improvement and how much is produced by futures price movement, as two separate sources. If the average basis improvement is less than the average hedging gain, return on storage investment will have a negative ROI and not cover the additional costs.

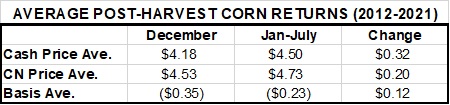

Opinions and preferences aside, what do the costs and returns show? From 2012-2021, the average cash price during December was $4.18 and improved to an average of $4.50 in post-harvest months, with an average annual price gain of $0.32/bu./yr. If the post-harvest marketing plan could capture the average annual marketing gain of $0.32, it could pay for a $3.50/bu facility at 6% interest in approximately 18-19 years. FYI: The annual cost to amortize the $3.50/bu loan in ten years is about $0.47-0.48/bu.

Breaking down the return further, the average increase in futures price was from $4.53 in December to $4.73 out of storage, for an average increase of $0.20/bu/yr. This part could be captured with negligible fees using futures or options. The average basis in December was $0.35 under, and improved to $0.23 under, for an average annual basis improvement of $0.12/bu/yr. When the return has been allocated to the contributing sources, the true return to storage would only cover about half of the interest on a $3.50/bu investment at 6% interest.

The remaining part of the analysis is to evaluate whether forward pricing for harvest delivery was sufficient and consistent enough to eliminate the need for storage as a part of the marketing plan? A companion study analyzed many hedging strategies using the same set of decision rules for each strategy for all 10 years (2012-2021). The average of two of the best performing strategies was an annual average net cash price of $4.79 ($4.18+$0.61) to the net storage price of $4.03 ($4.50 minus the annual amortization and maintenance costs of $0.47 for the storage facilities. If the harvest delivery plan is given credit for re-owning the inventory on paper to capture the $0.20/bu that was captured by holding naked inventory, the net cash price for the harvest delivered grain would be approximately $4.99 and approaching $0.96/bu more than the stored grain ($4.99-$4.03). The numbers indicate that investment in storage facilities can be a partial substitute for an effective marketing plan but, at least in this location for this10 years, the storage facilities would neither generate a positive ROI nor compete with forward pricing strategy for harvest delivery.

Posted by Keith D. Rogers, 5 November 2022