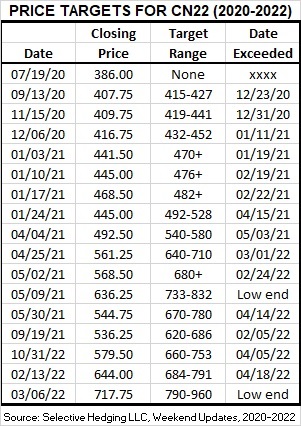

Three things jump out from the data in the table: 1) A trend was established and sustained, 2) The price projections were effective at guiding sales decisions, and 3) Forward contracting 1-2 years ahead did not do well relatively.

The projections cover the two years from July 2020 to 2022, and are from the Weekend Updates, Selective Hedging LLC. Only the dates with new projections are listed, and closing prices are the weekly closes. The projected targets are windows where the market has a high probability of turning if the rally is going to end, and are based on Fibonacci extensions. The dates when projections passed through the projected windows were pulled from the CN22 daily chart.

The goal of this system is to guide decisions on when to hold and when to benefit from the rally. They are NOT projected sell signals so the system will not meet the needs of price target marketing plans. This plan is to stay open as long as the market is trending up, and when it turns to lock in price and transfer the risk. Please note that a new projection was already in hand to override the earlier projection before the market entered the potential decision window. In short, the system said to stay open from the time CN20 expired and CN22 was first considered for forward pricing in 2020.

Using a 2-year lead for forward pricing, the base of the range was set at $3.86 in the 7/19/20 Update and the projected trend has been up continuously since, reaching a high close of $8.13 on 4/29/22. At the contract high, the range has been $4.27 and has added a potential of over $800/ac for 200 bushel corn ground. A realistic goal is to capture at least 60% or the range, allowing for 20% slippage at the top and bottom. Getting the sale in the top 20% of the range at this point, would mean getting a sale in place in an $0.85 window from $8.13 down to $7.28. If the original goal had been to get in the top 30% of the range, basically a sale over $6.85 will still achieve that goal. I can’t speak to whether individuals have the discipline to sell in a down market, but instead of a “sell above some mystical number” on the way up, orders can be placed now to sell if price falls below say $7.28. It is far too easy to get concerned about the $0.85 that might be missed at the top and lose track of the $3.42 that the system delivered.

A quick look at forward pricing performance. If the marketing plan had started with sales 2-years out, all sorts of combinations are possible. To make it simple, the price on 7/19/21 was $5.28 and the average for that period was $4.65. Within a range from $3.86 and the high at $6.58, the $4.65 average looks pretty weak, falling in the bottom 30% or the range. Now those sales are even worse and have fallen into the bottom 21% of the range to May 2022. The best that was available as a standard forward contract one year or more out was $6.58 minus fees and charges for a contract to lock in that futures price. From 7/1/21 to 4/29/22, the average close has been $6.15, and the high was $8.13. The $6.15 barely gets into the top 50% of the range, whereas the close last Friday was in the top 12% of the range.

The takeaway, is that there are systems with proven performance to simultaneously track market behavior, manage risk, and maximize revenue. They may or may not require forward contracting, depending entirely on the particular year, but that needs to be decided on the market behavior and not a preconceived notion that forward pricing will always generate average higher prices. Tracking the trend is an ideal plan, but many farmers are forced to make sales based on cash needs and not the market. That is a financial management problem to be worked out with a banker, not with a marketing advisor, and it must be recognize that the plan will be restricted and less productive than those who do not have financial constraints.

Posted by Keith D. Rogers 2 May 2022