David Widmar’s article posted by Successful Farming this week (95.0 Million U.S. Corn Acres In 2020?) reminded me of an article by Anna-Lisa Laca dated December 2017 and posted on AgWeb (Should You Listen to Market Analyst Price Outlooks?).

If you haven’t seen the Widmar article, the essence is a discussion of how and why we might anticipate a combined corn and soybean planting of 180 million acres, and why 95 million of that could end up in corn. In the Laca article, Mike North was quoted as saying analysts will come out of the woodwork with opinions, and that you should “heed none of them” because “nobody has a crystal ball.” North went on to advise that you should evaluate possible outcomes and say “OK, if these guys are right, what does it mean to me?”

That brings me back to Widmar’s article. What does the potential for 95 million acres of corn in 2020 mean to you? I assume that you need a price estimate associated with the acres to assess the impact on your budget and planning. There is no price estimate in the Widmar article, but I am sure that many opinions “will come out of the woodwork” as North anticipated two years ago. If anything, I would expect the range of opinions to be much greater this year than ever before as we face the global virus pandemic and escalated levels of uncertainly.

One point is clear. Everyone needs a base set of numbers to develop effective management and marketing plans. The plan must be flexible so management can constantly reassess conditions and adjust as conditions change throughout the growing season. That will, among other things, involve new supply estimates on a weekly or monthly basis from multiple sources.

What does 95 million acres of corn mean to all of us? Or what if it is 98? What if it is 90? With beginning stocks of 1.89 billion bushels, 91% harvested acres, and yield at 178.5 bushels per acres, we are looking at a marketing year average of $3.07-3.23. With the same assumptions and 90 million planted acres, think $3.41-3.59. At 98 million, think $2.90-3.04.

Now you have one opinion but let me qualify it. I certainly don’t have a crystal ball, so consider the source. It is obvious to me that analysts’ opinions with similar fundamental assumptions vary widely and leave some doubt about the reliability of those opinions. As Ray Grabanski pointed out in the Laca article, “Not all analysts’ opinions should be treated equally.”

The price ranges above were pulled from a Supply and Demand Model that I developed several years ago, not to nail the annual price of corn in one shot, but to establish a reference point to use in evaluating changes in the underlying fundamentals. The Model was constructed to create a simplified way to generate price estimates from basic supply and demand information. The most common use of the model is to associate prices with various production/supply levels when you have multiple supply estimates that need to be translated to price expectations for management and marketing plans. In reverse order, the second use of the model is to estimate what production/supply would generate a specific price target which you are considering, such as $4.50 per bushel. With assumptions as above, peg that at less than 13.1 billion production or 15.0 total supply.

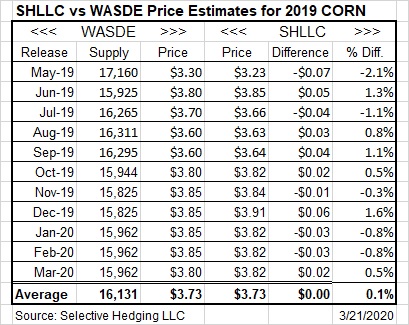

The table below is a summary of Selective Hedging LLC price estimates compared to the WASDE price estimates for the last 11 WASDE reports, starting with the first estimates for the 2019 crop back in May of 2019. The maximum difference was 2.1% or $0.07 back in May, and the average difference for all 11 reports is less than 0.1% or $0.01 above the WASDE estimates. Going back farther for the last three completed marketing years, 2016/17-2018/19, the average SHLLC price estimate was 1.2% (four cents) below the WASDE estimates. Grabanski said that “Producers should weigh the track record of market analysts to know if their opinion should be highly regarded or not.”

If you would like a complimentary price estimate for a given supply/production estimate, or a supply/production estimate for a specific price target, send me a request at hedging@grics.net.

Posted by Keith D. Rogers on 21 March 2020